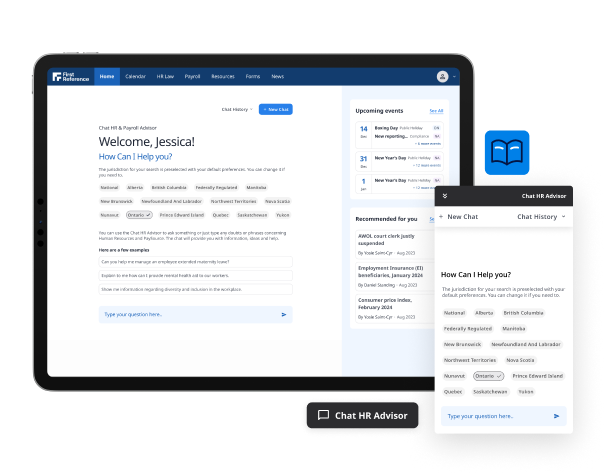

How do I stay compliant with HRA?

Your AI-Powered HR Assistant will help you:

Get immediate answers to HR/Payroll questions across Canada

Tap into 25 years of data and expertise

Understand the impact employment and payroll related-laws have on HR/Payroll practices and policies.

Get clarifications and interpretations to make informed decisions

Stay Informed

Access expert commentary from HR/payroll specialists and legal experts

Access in-depth, industry-specific commentary

Commentaries are regularly updated and made current

Receive weekly compliance news and updates

Learn about current and upcoming legal obligations and key court decision

Find anything in our user-friendly, comprehensive interface

Faciliate your task with the help of our AI assistant

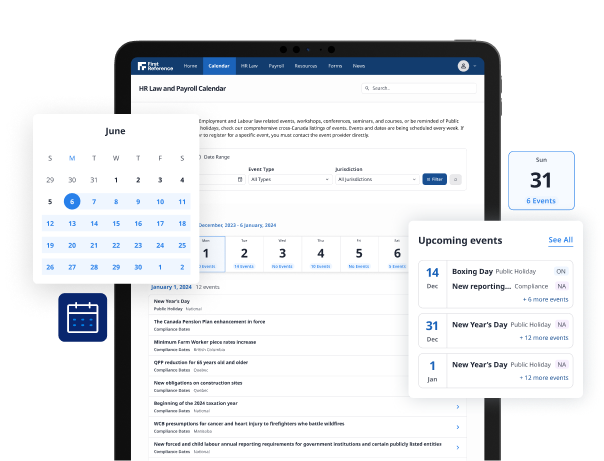

Compliance Calendar

HRA has a compiled list of helpful reminders to ensure your organization is well-prepared to tackle any compliance challenges that come your way.

Get clarity on coming into force of legislative changes

Know when to comply with public holidays as well as payroll filing deadlines

Meet your duty of care by knowing when a religious accommodation may be needed.

Stay on the right side of the law by getting timely reminders of critical dates

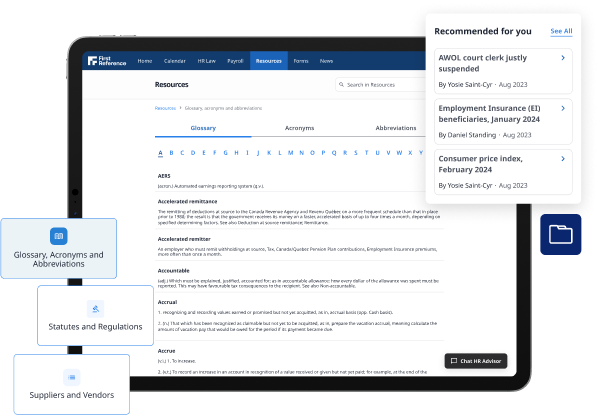

Access Resources by Canadian Jurisdiction

Follow proper federal, provincial, territorial and federally regulated rules

Compare minimum standards across jurisdictions with compliance charts

Find essential government, HR and payroll forms and documents for your jurisdiction

Get reminded of federal and jurisdiciton specific yearly payroll rates and amounts

Who is The Human Resources Advisor™ for?

Human Resources Advisor is for anyone who’s responsible for personnel or payroll at their organization. Whether you’re an HR/payroll professional, Executive Director, Manager/Supervisor, Office Administrator, General Manager, Business Owner, you’ll have access to an easily navigable librairy of commentaries and AI-supported answers that give you the compliance information you need when you need it.

HRA gives you in-depth, industry-specific insight that gives you a deeper understanding of the employment law and payroll legislation that affects your organization.